Your current location is:Fxscam News > Exchange Brokers

The price of gold is surging, approaching the target of $3,500.

Fxscam News2025-07-22 21:05:06【Exchange Brokers】8People have watched

IntroductionForeign exchange recommendations,China's personal foreign exchange trading platform,Amid the worsening U.S. fiscal situation and large-scale sell-off of U.S. debt in the market, gold i

Amid the worsening U.S. fiscal situation and Foreign exchange recommendationslarge-scale sell-off of U.S. debt in the market, gold is experiencing a vigorous rally. Spot gold (XAU/USD) strongly surpassed $3,340 per ounce on Wednesday, marking the fifth consecutive day of gains. This indicates robust safe-haven demand and deep market concerns over long-term debt risks.

The U.S. Treasury's announcement of the 20-year Treasury bond auction results showed a winning yield skyrocketing to 5.047%. Not only is this about 24 basis points higher than last month, but it is also the highest level since October 2023, and the second time in history that auction pricing has exceeded 5%. This result has shocked the market and further heightened concerns about the sustainability of U.S. finances.

Priya Misra, an investment manager at JPMorgan Asset Management, pointed out, "The bond market is sending a strong signal to policymakers that fiscal deficits cannot be ignored."

Gold: Multiple Positive Factors Driving Prices Higher

The recent rise in gold prices is not coincidental. In addition to the financial market turmoil caused by the surge in U.S. Treasury yields, escalating geopolitical risks in the Middle East and Moody's downgrade of the U.S. sovereign credit rating (from Aaa down) have collectively triggered a surge in global safe-haven sentiment, making gold once again a core asset favored by global investors.

Data shows that since mid-May, gold has risen by more than 7%. Institutional investors and safe-haven funds continue to flow into gold ETFs and the physical bullion market, pushing prices higher.

UBS Group's latest report indicates that gold prices are expected to reach $3,500 per ounce within the year. In a more aggressive risk-aversion scenario, they could even soar to $3,800. "The longer the Federal Reserve maintains high interest rates, the higher the debt cost, which structurally benefits gold in the long term," wrote UBS analysts.

Market Expectations: Short-term High Volatility, Long-term Bullish

From a technical standpoint, the breakthrough of the $3,300 barrier in gold prices has opened new upward space. The next phase will challenge previous highs of $3,350 per ounce and the psychological threshold of $3,400. If global risk factors continue to ferment, the surge to $3,500 or even $3,800 is not impossible.

However, analysts also caution that the sharp short-term rise in gold prices may face some profit-taking pressure. But the overall trend remains upward, especially given the ongoing increase in central banks' gold reserves globally and the unresolved uncertainty surrounding U.S. finances, which enhances the strategic value of gold allocation.

Conclusion:

As global financial markets reassess U.S. deficit risks and geopolitical tensions, gold is playing an increasingly important role as a safe haven. If U.S. Treasury yields remain high, the Federal Reserve delays a shift towards easing, and global risk events continue to escalate, gold may enter a true "super bull market" in 2024.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(7952)

Related articles

- One Global Market broker review: regulated

- The appreciation of the euro raises concerns for the European Central Bank.

- What is the Price Variation Margin? How is the Price Variation Margin calculated?

- Eurozone faces twin deficits as EU

- Market Insights: Jan 26th, 2024

- Silver rises as market focus shifts to tariffs and economic data.

- RMB exchange rate rebounds to 7.23, boosting bullish sentiment.

- Escalation of Middle East conflict pushes gold and oil prices higher amid rising risk aversion.

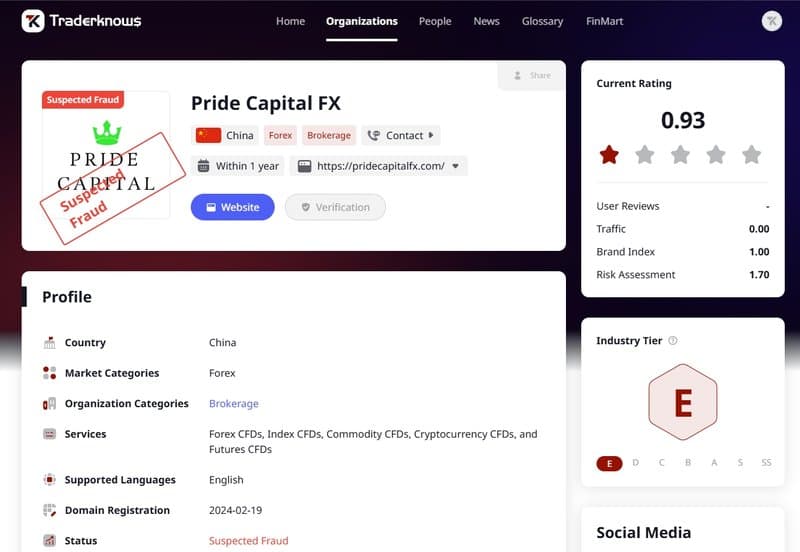

- Wingo Markets Review: High Risk (Suspected Fraud)

- U.S. Treasuries lose appeal as foreign investors may shift to domestic bond markets.

Popular Articles

- Orfinex trading platform Review: high risk (Suspected Fraud)

- OPEC and other producers pledge ongoing cuts, supporting oil prices near yearly highs.

- Katsunobu Kato emphasizes the need for dialogue and reform to stabilize the government bond market.

- China's demand could pose a threat to crude oil bulls.

Webmaster recommended

Is Aircrypt Trades compliant? Is it a scam?

Brazilian energy giant "targets" Bolivian lithium resources

The dollar has slightly picked up, but confidence remains shaken.

What is the Price Variation Margin? How is the Price Variation Margin calculated?

假冒和套用?一文了解Yingke的诈骗小手段

Goldman Sachs warns of increasing risk of dollar depreciation.

The weakening of the US dollar has led the Chinese yuan to fall to a 17

Japanese wage increases hit a record high, with the yen surging close to 147.